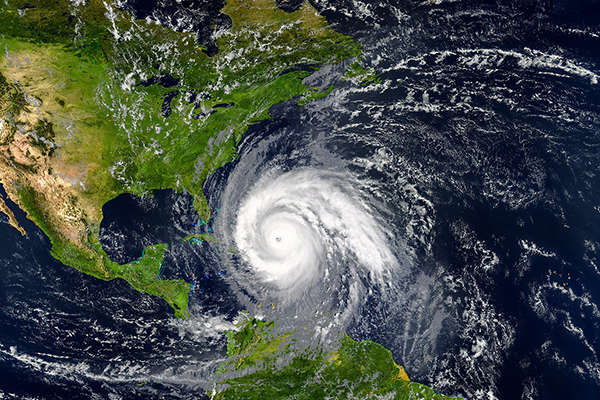

Florida’s hurricane season—June 1 to November 30, 2025—is underway. This period poses significant challenges for commercial real estate managers across the state. Drawing from guidance by Advanced Collection Bureau and Florida Realtors®, here’s a streamlined playbook for protecting your investments and ensuring business continuity.

1. Conduct a Targeted Risk Assessment

Start with a comprehensive risk audit of your commercial assets:

- Evaluate structural vulnerabilities—inspect roofs, façades, doors, windows, drainage systems, and any exterior attachments.

- Upgrade proactively—consider hurricane-rated windows, reinforced loading docks, and wind-resilient roofing materials, especially for properties in high-risk coastal zones.

- Minimize debris risk—trim trees, secure signage and exterior fixtures, and eliminate potential projectiles.

2. Optimize Insurance & Mitigation Coverage

For commercial properties, the potential financial exposure can be substantial:

- Review insurance carefully—ensure policies cover both wind and flood damage; typical commercial insurance may leave gaps.

- Explore mitigation programs—resources like My Safe Florida Home may offer inspections or retrofitting incentives that reduce long-term repair costs.

3. Establish Clear Communication Protocols

- Pre-season planning—create and share emergency preparedness guides with commercial tenants, including evacuation instructions, emergency contacts, and steps to take pre-storm.

- Multi-channel alerts—utilize email, property management platforms, SMS, or signage systems to disseminate real-time updates before, during, and after storms.

- Tenant support—encourage tenant confirmation of business insurance, especially regarding flood coverage.

4. Stock and Deploy Emergency Supplies

Have essential preparedness tools in place, adjustable for commercial use:

- Common-area readiness—ensure shared spaces have accessible items like sandbags, tarps, flashlights, battery packs, and first-aid kits.

- Backup power strategies—generators are often invaluable for preserving critical systems and minimizing business disruption.

- Service agreements—secure contracts with trusted roofers, electricians, water damage specialists, and general contractors ahead of time for rapid response.

- Tax incentives—take advantage of Florida’s disaster sales tax holiday (June 1–14), when hurricane essentials like generators, tarps, and flashlights may be tax-exempt.

5. Coordinate Post-Storm Recovery Efforts

Swift, well-documented action after a storm can protect assets and livelihoods:

- Document thoroughly—capture photos and video of all damage for insurance claims and internal review.

- Communicate transparently—inform tenants about inspection outcomes, repair timelines, and any necessary temporary access restrictions.

- Restore services efficiently—prioritize restoring crucial building systems: power, HVAC, elevators, and security. Fast action helps tenants resume operations quickly.

6. Strengthen Resilience and Business Continuity

- Emergency plans for special needs—coordinate with local authorities for tenants needing assistance, and ensure plans include visitors or staff with mobility or medical needs.

- Avoid hazard zones—if your portfolio includes EV charging stations or electric vehicle access, ensure they are placed outside of saltwater flood zones to reduce risk of damage or battery hazards.

- Encourage tenant readiness—encourage commercial tenants to have their own emergency kits, evacuation strategies, and document protection plans (for inventory, equipment, and leases).

Sources:

https://www.advancedcb.com/post/how-property-managers-can-prepare-for-hurricane-season-in-florida

https://www.floridarealtors.org/newsroom/Florida-Realtors-Prepare-for-Hurricane-Season